How much is an asteroid worth?

February 15, 2013

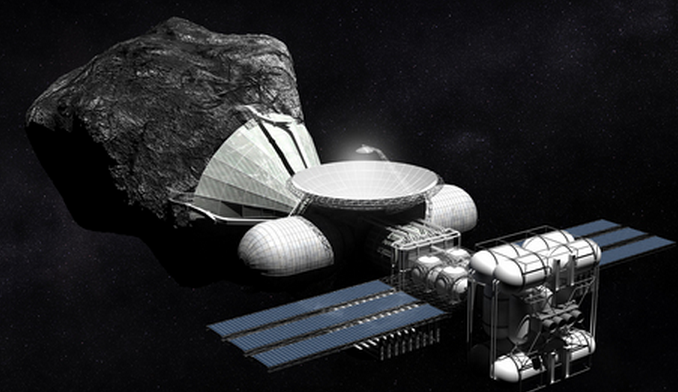

Asteroid fuel mining concept (credit: Deep Space Industries)

When asteroid 2012 DA14 flies by Earth today, we could be watching a fortune fly over our heads and disappear into the void.

DA14 could be worth up to $195 billion in metals and propellant, Deep Space Industries (DSI) said in a statement — if it were in a different orbit … and if we had a space-based asteroid mining operation.

Which we don’t. Problem is, explains DSI, sending fuel, water, and building materials into high Earth orbit costs at least $10 million per ton, even using new lower-cost launch vehicles [like the SpaceX Dragon] just now coming into service.

Nonetheless, DSI, Planetary Resources, and independent experts are aggressively exploring promising future options for asteroid mining.

BREAKING NEWS: Meteorites slam into Russia as meteor seen streaking through morning sky

“A meteor streaked across the sky above Russia’s Ural Mountains on Friday morning, causing sharp explosions and injuring more than 500 people,” reports CBS. Could this be related to the DA14 asteroid? The European Space Agency says no.

Fueling satellites

“Getting these supplies to serve communications satellites and coming crewed missions to Mars from in-space sources like asteroids is key — if we are going to explore and settle space,” said Rick Tumlinson, Chairman of DSI. “While this week’s visitor isn’t going the right way for us to harvest it, there will be others that are, and we want to be ready when they arrive.”

According to DSI experts, if 2012 DA14 contains 5% recoverable water, that alone — in space as rocket fuel — might be worth as much as $65 billion. If 10% of its mass is easily recovered iron, nickel and other metals, that could be worth — in space as building material — an additional $130 billion.

Deep Space Industries plans to send small probes called FireFlies to examine asteroids and allow comparisons with readings taken by Earth and space based telescopes. They are to be followed by DragonFly sample return missions, to lay the groundwork for potential space mining operations in the 2020 time frame.

That assumes the future cost of launching to orbit will be a lot lower. If and when that happens, satellite companies will be paying attention. “Each additional year of life for a Sirius XM satellite is worth over $3 billion with some 25 million subscribers paying about $15 per month, not to mention the life-saving benefits of our real-time XM in-flight weather advisories to general aviation,” Dr. Martine Rothblatt, creator and former Chairman/CEO of Sirius XM, told KurzweilAI.

“Due to the relentless need to expend station-keeping fuel to maintain orbital parameters, our satellites must be replaced every 10–15 years, and at a cost of hundreds of millions of dollars. These numbers clearly indicate the economic value of asteroid-derived station-keeping fuel delivered to Sirius XM satellites on-orbit is in the tens of millions of dollars per year.”

Precious metals from asteroids

So what about mining asteroids for precious metals like platinum and returning them to Earth? That’s a more expensive, longer-range proposition, asteroid mining experts tell us. However, “high-grade platinum-group metal concentrations have been identified in an abundant class of near-Earth asteroids known as LL Chondrites,” according to geologist and asteroid mining expert Brad Blair in a year-2000 report. Blair noted that a 1000-meter-diameter asteroid in that class could provide platinum worth $690 billion, assuming complete recovery of platinum.

John S. Lewis, professor of planetary science and author of Mining the Sky: Untold Riches from the Asteroids, Comets, and Planets, takes it much further. He has estimated that asteroid 3554 Amun is worth $20 trillion, including iron, nickel, and cobalt in addition to platinum — enough to pay off the U.S. national debt, currently approaching $16.5 trillion.

However, that estimate assumes the price of platinum would remain stable given a sudden increase in supply, and that customers would line up to buy all of the platinum that would be offered at that price —“highly unrealistic assumptions,” Blair told KurzweilAI.