How seasonal moods affect investments

October 12, 2011

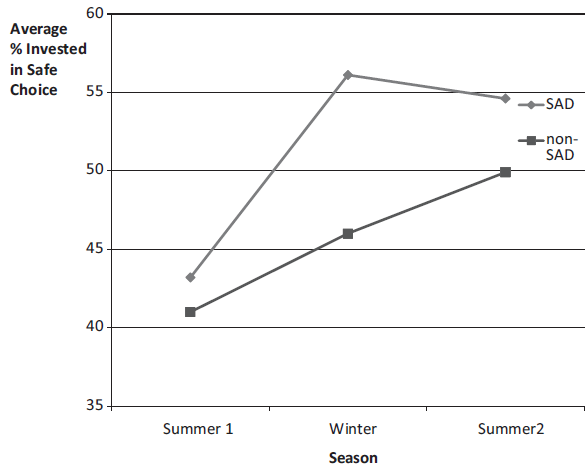

Seasonal fluctuations in financial risk aversion as a function of seasonal affective disorder (SAD) (credit: Lisa A. Kramer and J. Mark Weber/Social Psychological and Personality Science)

People who experience seasonal depression shun financial risk-taking during seasons with diminished daylight, but are more willing to accept risk in spring and summer, a study by prof. Lisa Kramer of the University of Toronto’s Rotman School of Management and Waterloo’s Mark Weber suggests.

The researchers based their findings on a study of faculty and staff at a large North American university. Participants were paid for each part of the study they joined, which included online surveys and behavioral assessments.

They also had the option of putting some or all of their payment into an investment with 50:50 odds and where the potential gains exceeded the potential losses, to mimic financial risk. Participants who experienced seasonal depression chose more of the guaranteed payments and put less money at risk in winter, but their risk tolerance came more into line with other participants’ in summer.

About 10 percent of the population suffers from severe seasonal depression, known as seasonal affective disorder (SAD); other still experience some degree of seasonal fluctuation in mood. Previous research has noted that seasonal patterns in stock market returns have been consistent with people avoiding risk in the fall and winter.

Ref.: Lisa A. Kramer & J. Mark Weber, This is Your Portfolio on Winter: Seasonal Affective Disorder and Risk Aversion in Financial Decision Making, Social Psychological and Personality Science, 2011; [DOI: 10.1177/1948550611415694] (free access)