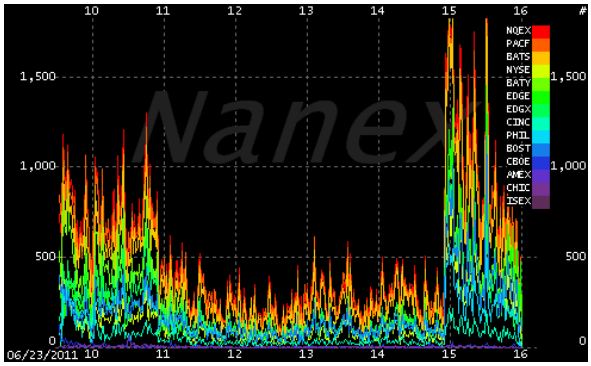

Mysterious algorithm was 4% of trading activity last week

October 11, 2012

A single mysterious computer program that placed orders — and then subsequently canceled them — made up 4 percent of all quote traffic in the U.S. stock market last week, according to the top tracker of high-frequency trading activity.

The motive of the algorithm is still unclear, CNBC reports.

The program placed orders in 25-millisecond bursts involving about 500 stocks, according to Nanex, a market data firm. The algorithm never executed a single trade, and it abruptly ended at about 10:30 a.m. ET Friday.

“My guess is that the algo was testing the market, as high-frequency frequently does,” says Jon Najarian, co-founder of TradeMonster.com. “As soon as they add bandwidth, the HFT crowd sees how quickly they can top out to create latency.” (Read More: Unclear What Caused Kraft Spike: Nanex Founder.)

Translation: The ultimate goal of many of these programs is to gum up the system so it slows down the quote feed to others and allows the computer traders (with their co-located servers at the exchanges) to gain a money-making arbitrage opportunity.

The scariest part of this single program was that its millions of quotes accounted for 10 percent of the bandwidth that is allowed for trading on any given day, according to Nanex. (The size of the bandwidth pipe is determined by a group made up of the exchanges called the Consolidated Quote System.)

“Your scientists were so preoccupied with whether or not they could, they didn’t stop to think if they should. … We’re in the hands of engineers. … All major changes are like death. You can’t see what is on the other side until you get there.: Jurassic Park. — Ed.