This is what Wall Street’s terrifying robot invasion looks like

August 8, 2012

This animated GIF chronicles the rise of the HFT Algo Machines from January 2007 through January 2012 (credit: Nanex Research, hosted by imgur.com)

Given the the endless mind-whirling acronyms, derivatives and structures of the financial markets, we’re rarely served with a visualization that so elegantly illustrates the arrival of Wall Street’s latest innovation.

This is what high frequency trading looks like, when specially programmed computers make massive bets at lightning speed, Mother Board reports.

Created by Nanex, the GIF charts the rise of HFT trading volumes across all U.S. stock exchanges between 2007 and 2012. The initial murmur, the brewing storm, the final detonation: Not just unsettling, it’s terrifying.

As Mother Board notes, we don’t know is what the long term consequences are of all this hyper-volume as depicted by the Nanex GIF and the kind of systemic risks created from the market’s ongoing evolution from human traders to rapidfire AI. Sometimes things go wrong, a software glitch, an algorithm gone rogue and the music stops, like last week when Knight Capital lost $10 million a minute when it’s trading platform went haywire or during the infamous Flash Crash when the Dow dropped 1000 points in mere minutes.

Read the excellent full Mother Board article here.

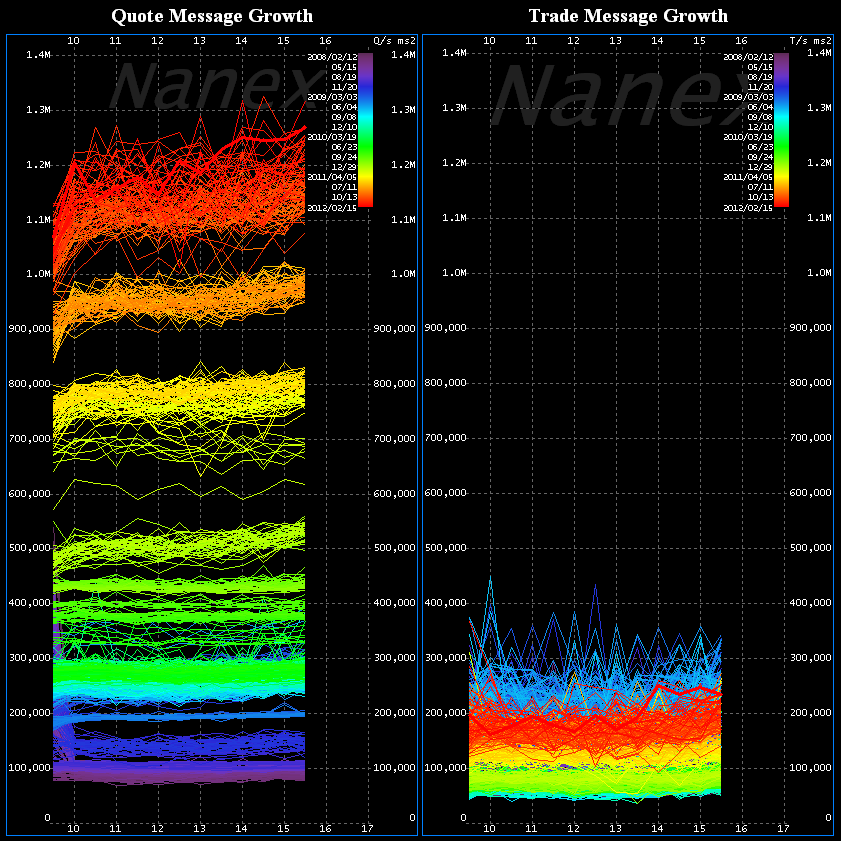

However, according to Nanex Research, “It’s not high frequency trading (HFT) that concerns us. It’s high frequency quoting, and it should concern everyone. The two images below tell the story. The chart on the left shows the growth of high frequency quoting. The chart on the right shows the (lack of) growth of high frequency trading.

Quote data is fromCQS, trade data is from CTA, both which cover listed stocks on NYSE, AMEX, and NYSE-Arca between 2008 and 2012. Quote spam has exploded with no signs of stopping, while trade frequency has stalled and is actually lower than it was years ago.

Each day is plotted in a separate color over the course of a trading day (9:30 to 16:00 Eastern): older data uses colors towards the violet end of the spectrum, recent data towards the red end of the spectrum. The gaps you see between color groups on the quote chart (left-side) is when system capacity was upgraded to handle the increase in traffic, and quote spam jumped to fill the new capacity that very same day.