Market Data Firm Spots the Tracks of Bizarre Robot Traders

August 5, 2010 | Source: The Atlantic

Nanex, the data services firm, has discovered mysterious and possibly nefarious trading algorithms are operating every minute of every day in the nation’s stock exchange. Unknown entities for unknown reasons are sending thousands of orders a second through the electronic stock exchanges with no intent to actually trade.

Often, the buy or sell prices that they are offering are so far from the market price that there’s no way they’d ever be part of a trade. The bots sketch out odd patterns with their orders, leaving patterns in the data that are largely invisible to market participants.

The company’s software engineer Jeffrey Donovan thinks that the odd algorithms are just a way of introducing noise into the works. Other firms have to deal with that noise, but the originating entity can easily filter it out because they know what they did. Perhaps that gives them an advantage of some milliseconds.

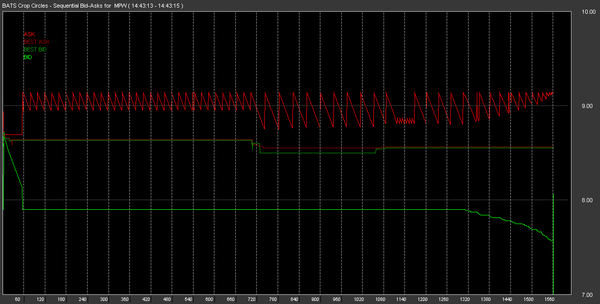

Software engineer Jeffrey Donovan stared and stared at the data. He began to think that he could see odd patterns emerge from the numbers. He had a hunch that if he plotted the action around a stock sequentially at the millisecond range, he'd find something. When he tried it, he was blown away by the pattern. He called it "The Knife." (Nanex)